Roth conversion tax calculator 2020

If you want to invest in a Roth IRA but dont meet the income requirements you can still take advantage of the tax-free growth and distributions down the road through a backdoor Roth conversion. Filing Status 2022 Modified AGI Contribution Limit.

Traditional Vs Roth Ira Calculator

Join us now to hear more about Gift and Estate Tax Opportunities Charitable Planning Inflation and Tech Volatility.

. From IRS Publication. Traditional IRAs 401k vs IRA IRA Roth Conversion How to convert to a Roth IRA online Start simple with your age and income. Roth IRAs have no RMDs during the owners.

Then move the money into a Roth IRA using a Roth conversion. The answer is a definite Yes Youre permitted to roll the after-tax contributions from a. I received a 1099-R tax form showing an RMD from 2020 that I returned to my IRA before the August 31 2020 deadline outlined in the CARES Act.

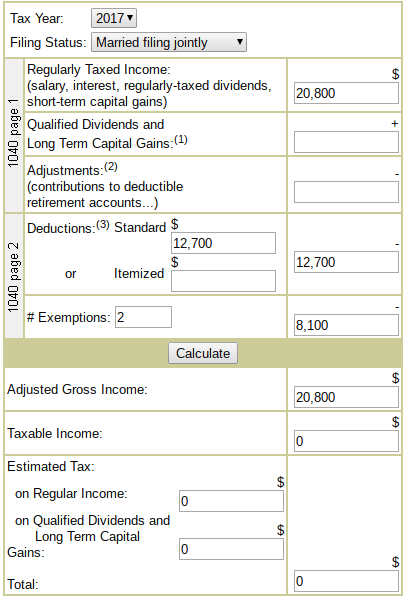

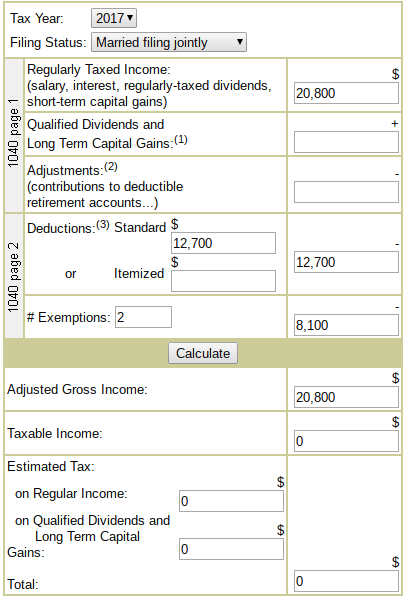

Atlanta GA July 2020. It makes the effective marginal tax rate on the additional 10000 income 27 not 12. Remember that you are making two distinct tax calculations.

Based upon IRS Sole Proprietor data as of 2020 tax year 2019. If you withdraw less than the RMD amount you may owe a 50 penalty tax on the difference. You can withdraw your contributions from a Roth IRA at any time tax-free and penalty-free.

A Roth IRA even via a conversion has the potential to benefit your retirement and legacy planning. At the end of 2021 the fair market values of her accounts including earnings total 20000. A conversion can get you into a Roth IRAeven if your income is too high.

Make your retirement plan solid with tips advice and tools on individual retirement accounts 401k plans and more. If your conversion includes contributions made in 2021 for 2020 youll need to check your 2020 return to make sure it includes Form 8606 Nondeductible IRAs. Asset Allocation in Trying Times.

Calculation 1 determines the net earnings for your business. Self-Employed defined as a return with a Schedule CC-EZ tax form. Married filing jointly or qualifying widower Less than 204000.

Converting to a Roth IRA may ultimately help you save money on income taxes. Bob an employee leaves Company A on December 31 2020. Financial calculators for all your financial needs.

Traditional and Roth IRAs. She completed the conversion before December 31 2021 and didnt recharacterize any contributions. To get back the tax you paid on the conversion you would then need to file an amended tax return using Form 1040-X by the due date for amended returns.

Usually you have three years after the date you filed the original return but you shouldnt wait that long to seek a refund from reversing a Roth conversion What to show on your tax return. In 2021 and 2022 you can contribute a total of up to 6000 7000 if youre 50 or older to your traditional IRAs and Roth IRAs. You can also specify whether or not each of your pensions is taxable.

An IRS ruling clarified this in September 2014. Calculation 2 determines how much tax-exempt contributions you can make to your Solo 401k. Claim Solo 401k Contributions on Your Tax Return for a Pass-Through Business.

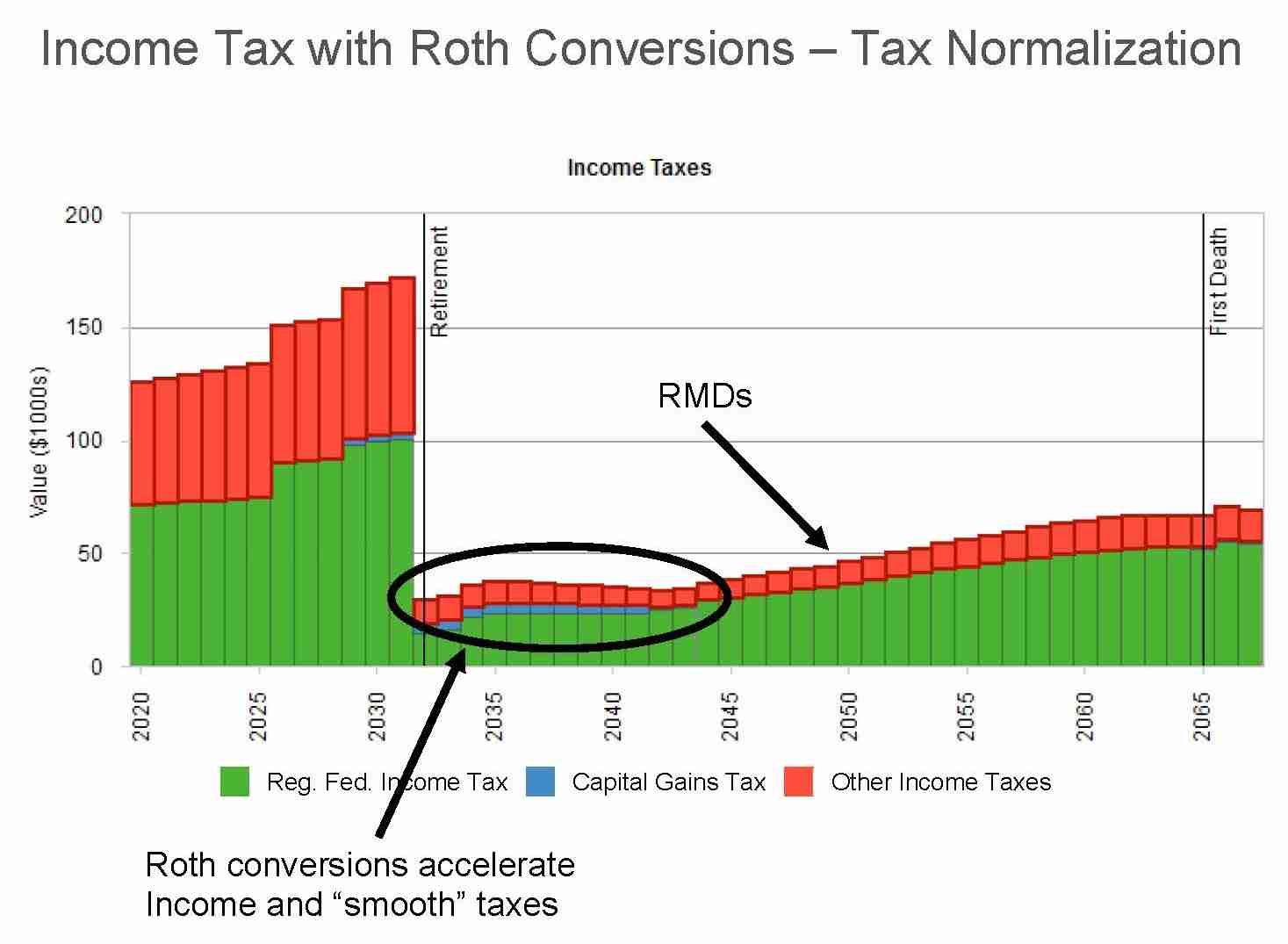

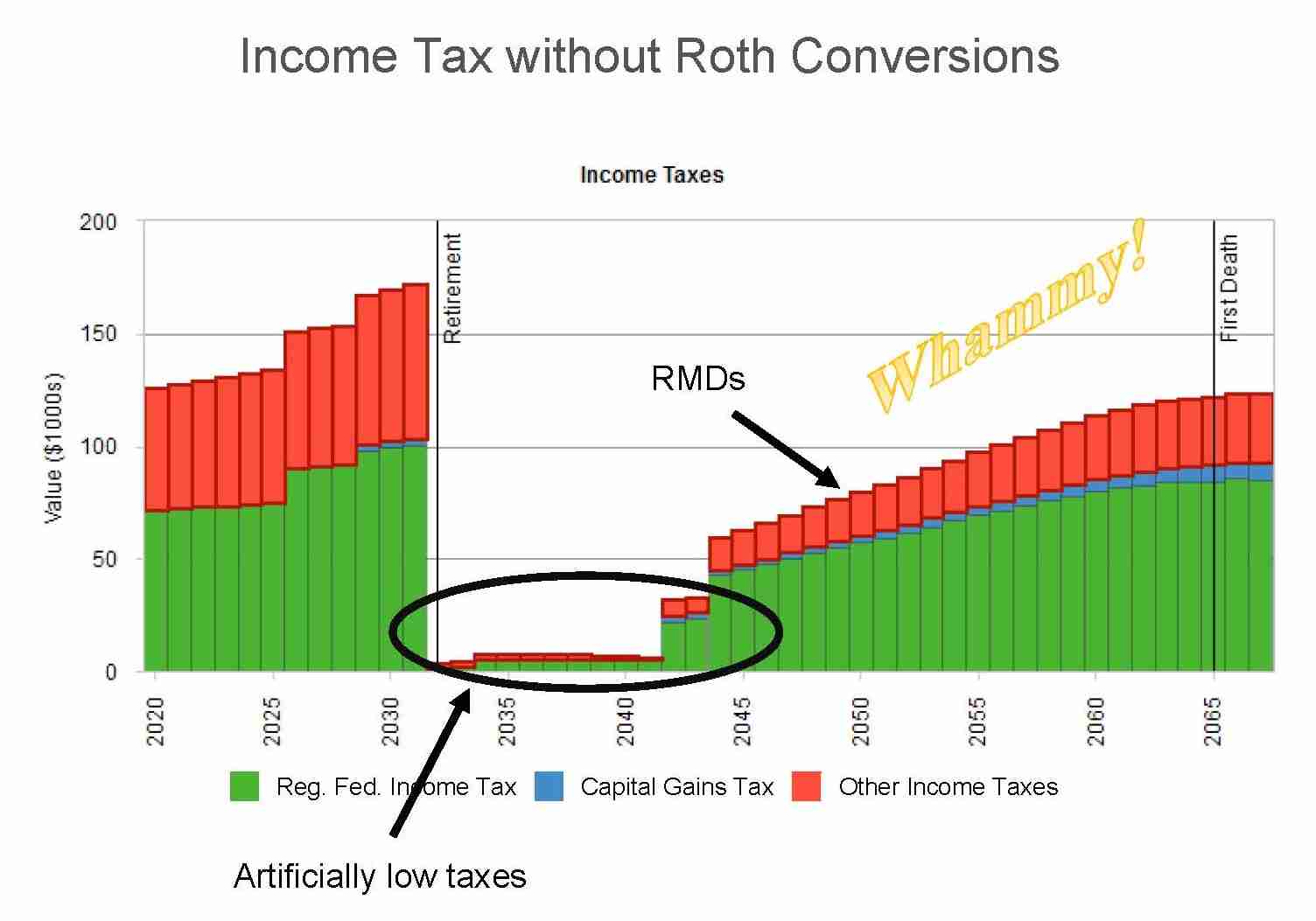

However due to the Trump tax cuts formally known as the Tax Cuts and Jobs Act of 2017 TCJA your federal tax rate is likely still relatively low making a Roth conversion more affordable now than years ago. Other Advantages to a Roth Conversion. Besides the reasons listed above here are a few additional advantages to doing a Roth.

Having the correct mindset is important here. Calculate Your Direct Mail ROI. To minimize the tax risks of a backdoor Roth IRA make your.

Americas 1 tax preparation provider. Pick investments for your IRA Roth vs. Roth IRAs are first in first out which means all of your contributions are withdrawn before earnings.

Named for Delaware Senator William Roth and established by the Taxpayer Relief Act of 1997 a Roth IRA is an individual retirement plan a type of qualified retirement plan that bears. A conversion of a traditional IRA to a Roth IRA and a rollover from any other eligible retirement plan to a Roth IRA made after December 31 2017 cannot be recharacterized as having been made to a traditional IRA. 6000 7000 if youre age 50 or older.

2022 Roth IRA Income Limits. Please speak with your tax advisor regarding the impact of this change on future RMDs. She also receives a distribution of 5000 for conversion to a Roth IRA.

It completely negated the need to take an RMD for the 2020 tax year. Donating IRA assets to a charity. Mortgage calculators retirement calculators cash flow calculators saving calculators college calculators credit calculators debt calculators tax calculators insurance calculators paycheck calculators benefit calculators qualified plan calculators and investment calculators.

For instance if you expect your income level to be lower in a particular year but increase again in later years you can initiate a Roth conversion to capitalize on the lower income tax year and then let that money grow tax-free in your Roth IRA account. Normally its a good idea to consider Roth conversion or harvesting tax gains in the 12 tax bracket but those moves become much less attractive when you receive a premium subsidy for the ACA health insurance. If this form isnt included in your 2020 return youll need to fill out a 2020 Form 8606 to record your nondeductible basis for conversion and mail this form to your designated IRS office.

IRS Rules About Rolling After-Tax Funds to a Roth. You can restart or begin taking your RMDs in 2021 for the 2021 tax year without the need to take one retroactively for 2020. IRA Contribution Calculator Answer a few questions to find out whether a Roth or traditional IRA might be right for you.

1 online tax filing solution for self-employed. Plan provides that contributions must be allocated as of June 30. Review 2022 tax information and get resources and tax documents to help you stay informed of tax changes that may affect you.

First place your contribution in a traditional IRAwhich has no income limits. 2020 and before December 31 2020. Calculators Retirement Planner Retirement Calculator Roth Conversion Calculator Lifetime Annuity Calculator Reverse.

The financial planning and tax community wasnt sure for many years whether after-tax funds in a company plan could legally be rolled into a Roth IRA. For example if you contributed 5000 per year to your Roth IRA for the last 10 years you could withdraw as much as 50000 at any time without. In 2021 she makes a 2000 contribution that may be partly nondeductible.

The conversion would be part of a 2-step process often referred to as a backdoor strategy. Ten income and estate tax planning strategies for 2020. Add to your web site.

As the leader in tax preparation more federal returns are prepared with TurboTax than any other tax preparation provider. Roth IRA conversion calculator.

Converting An Ira To A Roth Ira After Age 60 Carmichael Hill

The Tax Trick That Could Get An Extra 56 000 Into Your Roth Ira Every Year

Retirement Withdrawal Calculator How Long Will Your Savings Last In Retirement Updated For 2020 Investing For Retirement Personal Finance Lessons Spending Money Wisely

Roth Ira Conversions And Taxes Brownlee Wealth Management

There S A Big Difference Between A Roth Ira And A Traditional Ira Find Out Which Is Best For Retirement Savings Traditional Ira Roth Ira Ira

Roth Conversion Calculator Fidelity Investments

The Ultimate Roth Ira Conversion Guide For 2022 Rules Taxes

Download Roth Ira Calculator Excel Template Exceldatapro

What Are Roth Ira Accounts Nerdwallet Roth Ira Ira Investment Individual Retirement Account

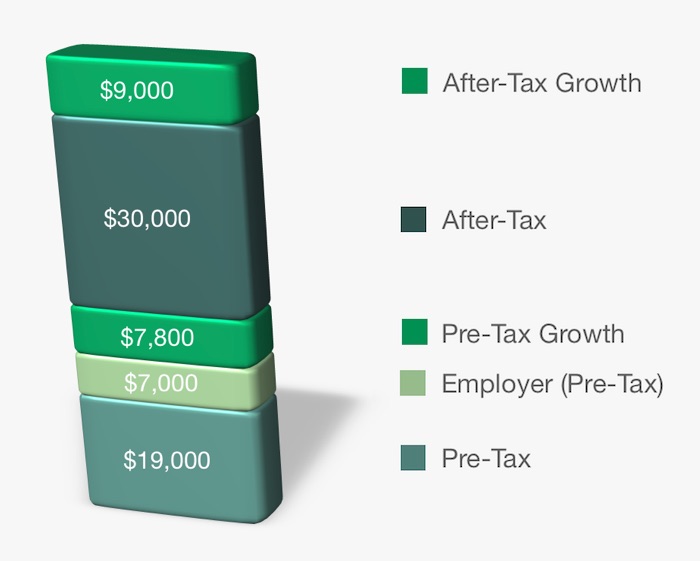

Mega Backdoor Roth

Systematic Partial Roth Conversions Recharacterizations

The Ultimate Roth Ira Conversion Guide For 2022 Rules Taxes

A Roth Ira Conversion Is Probably A Waste Of Time And Money For Most

Traditional Vs Roth Ira Calculator

Traditional Ira To Roth Ira Conversion For Deployed Military

The Ultimate Roth Ira Conversion Guide For 2022 Rules Taxes

Converting An Ira To A Roth Ira After Age 60 Carmichael Hill